16 Jul Canadian home sales activity improves in June

Ottawa, ON, July 16, 2018 – Statistics released today by The Canadian Real Estate Association (CREA) show national home sales were up from May to June 2018.

Highlights:

- National home sales rose 4.1% from May to June.

- Actual (not seasonally adjusted) activity was down 10.7% from June 2017.

- The number of newly listed homes eased 1.8% from May to June.

- The MLS® Home Price Index (HPI) in June was up 0.9% year-over-year (y-o-y).

- The national average sale price edged down 1.3% y-o-y in June.

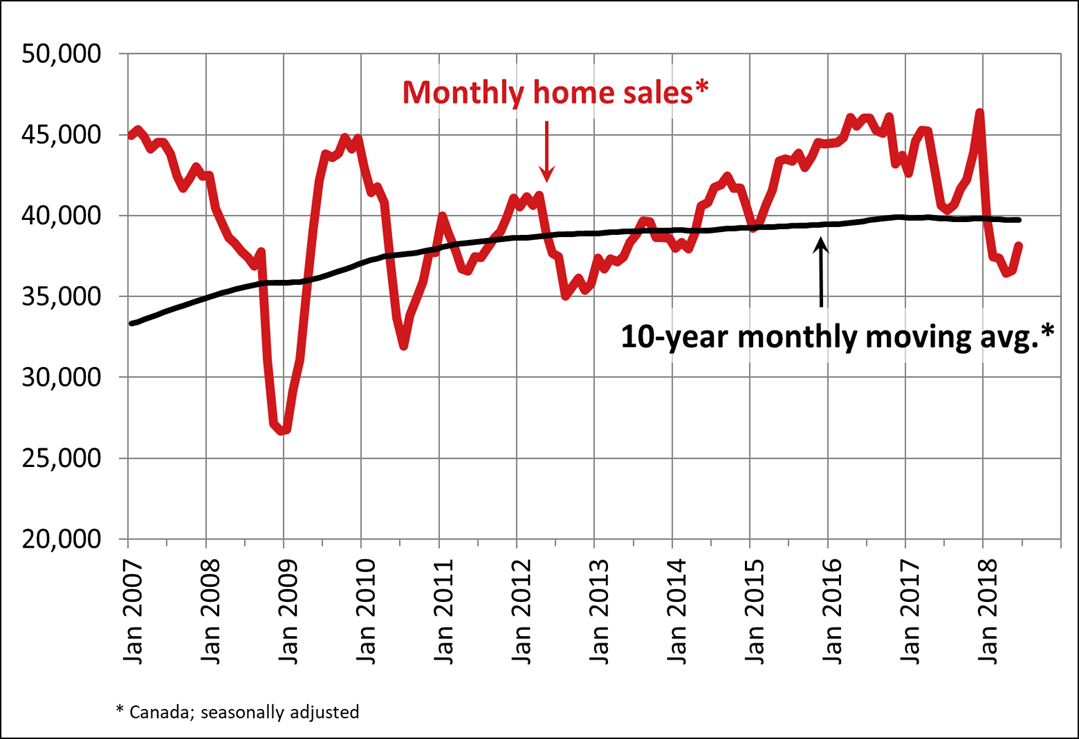

National home sales via Canadian MLS® Systems rose 4.1% in June 2018 compared to May. While this marks the first substantive month-over-month increase this year, sales remain well down from monthly levels recorded over the past five years. (Chart A)

More than 60% of all local housing markets reported increased sales activity in June compared to May, led by the Greater Toronto Area (GTA). By contrast, sales in British Columbia continue to moderate.

Actual (not seasonally adjusted) activity was down almost 11% compared to June 2017. Sales marked a five-year low and stood almost 7% below the 10-year average for the month of June. Activity came in below year-ago levels in about two-thirds of all local markets, led overwhelmingly by those in the Lower Mainland of British Columbia.

“This year’s new stress-test on mortgage applicants has been weighing on homes sales activity; however, the increase in June suggests its impact may be starting to lift,” said CREA President Barb Sukkau. “The extent to which the stress-test continues to sideline home buyers varies by housing market and price range. All real estate is local, and REALTORS® remain your best source for information about sales and listings where you live or might like to in the future,” said Sukkau.

“The national increase in June home sales suggests activity may indeed be starting to turn the corner,” said, Gregory Klump, CREA’s Chief Economist. “Even so, the number of homes trading hands has a long way to go before it returns to levels posted in recent years. Looking ahead, home sales activity and price gains will likely be held in check by higher interest rates.”

The number of newly listed homes retreated 1.8% in June, and also stood below levels for the month in recent years. New listings declined in a number of large urban markets, including those in British Columbia’s Lower Mainland, Calgary, Edmonton, Ottawa and Montreal.

With sales up and new listings down, the national sales-to-new listings ratio tightened to 54.3% in June compared to 51.2% in May. The June reading was within short reach of the long-term average of 53.4%.

Consideration of the degree and duration to which market balance readings are above or below their long-term average is a useful way to gauge whether local housing market conditions favour buyers or sellers. Market balance measures that are within one standard deviation of their long-term average are generally consistent with balanced market conditions.

Based on a comparison of the sales-to-new listings ratio with its long-term average, about two-thirds of all local markets were in balanced market territory in June 2018.

The number of months of inventory is another important measure for the balance between housing supply and demand. It represents how long it would take to liquidate current inventories at the current rate of sales activity.

There were 5.4 months of inventory on a national basis at the end of June 2018, down from the three-year high of 5.6 months in May. The long-term average for the measure is 5.2 months.

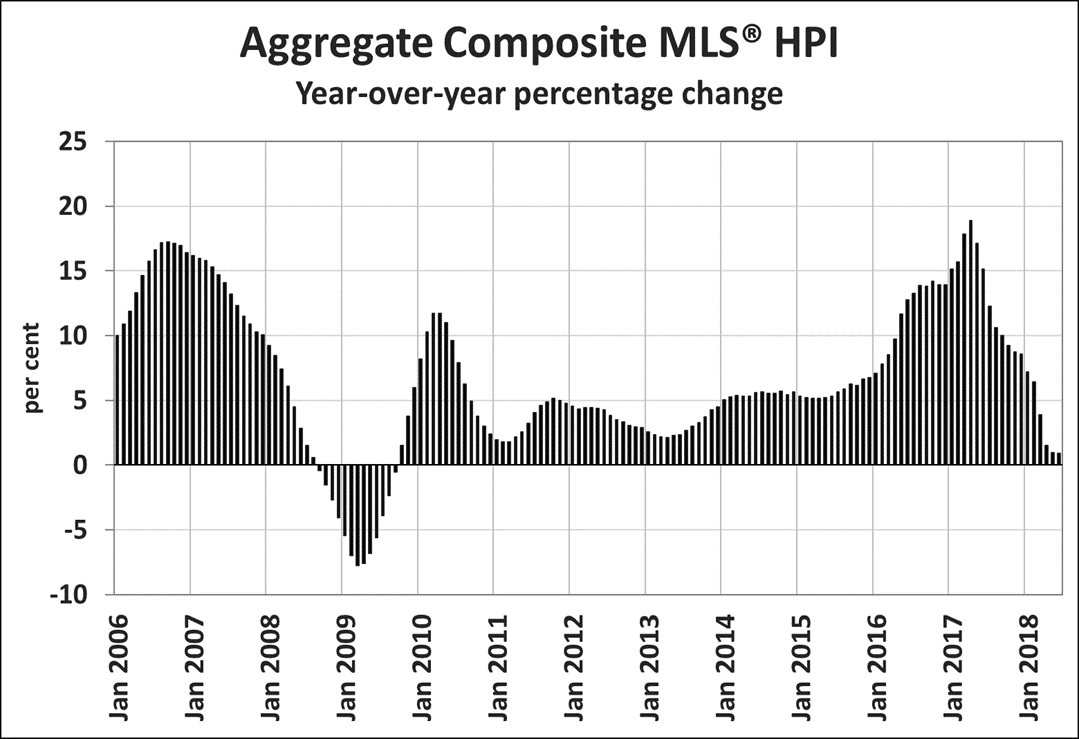

The Aggregate Composite MLS® HPI was up 0.9% y-o-y in June 2018, marking the 14th consecutive month of decelerating gains. It was also the smallest increase since September 2009. (Chart B)

Decelerating y-o-y home price gains have largely reflected trends at play in Greater Golden Horseshoe (GGH) housing markets tracked by the index. Home prices in the region has begun to stabilize and trend higher on a month-over-month basis in recent months.

Apartment units again posted the largest y-o-y price gains in June (+11.3%), followed by townhouse/row units (+4.9%); however, price gains for these homes have decelerated this year. By contrast, one-storey and two-storey single family home prices were again down from year-ago levels in June (-1.8% and -4.1% respectively).

With home prices having climbed above year-ago levels in 8 of the 15 markets tracked by the index, price trends continue to vary among housing markets.

Home price growth is moderating in the Lower Mainland of British Columbia (Greater Vancouver Area: +9.5% y-o-y; Fraser Valley: +18.4%), Victoria (+10.6%) and elsewhere on Vancouver Island (+16.5%).

Within the GGH region, price gains have slowed considerably on a y-o-y basis but remain above year-ago levels in Guelph (+3.5%). By contrast, home prices in the GTA, Oakville-Milton and Barrie were down from where they stood one year earlier (GTA: -4.8%; Oakville-Milton: -2.9%; Barrie and District: -6.5%). The declines reflect rapid price growth recorded one year ago and masks recent month-over-month price gains in these markets.

Calgary and Edmonton benchmark home prices were down slightly on a y-o-y basis (Calgary: -1%; Edmonton: -1.5%), while prices declines in Regina and Saskatoon were comparatively larger (-6.1% and -2.9%, respectively).

Benchmark home prices rose by 7.9% y-o-y in Ottawa (led by a 9.1% increase in two-storey single family home prices), by 6.4% in Greater Montreal (led by a 7.4% increase in townhouse/row unit prices) and by 6% in Greater Moncton (led by a 6.5% increase in one-storey single family home prices). (Table 1)

The MLS® Home Price Index (MLS® HPI) provides the best way of gauging price trends because average price trends are strongly distorted by changes in the mix of sales activity from one month to the next.

The actual (not seasonally adjusted) national average price for homes sold in June 2018 was just under $496,000, down 1.3% from one year earlier. While this marked the fifth month in a row in which the national average price was down on a y-o-y basis, it was the smallest decline among them.

The national average price is heavily skewed by sales in the Greater Vancouver and GTA, two of Canada’s most active and expensive markets. Excluding these two markets from calculations cuts almost $107,000 from the national average price, trimming it to just over $389,000.

– 30 –

PLEASE NOTE: The information contained in this news release combines both major market and national sales information from MLS® Systems from the previous month.

CREA cautions that average price information can be useful in establishing trends over time, but does not indicate actual prices in centres comprised of widely divergent neighbourhoods or account for price differential between geographic areas. Statistical information contained in this report includes all housing types.

MLS® Systems are co-operative marketing systems used only by Canada’s real estate Boards to ensure maximum exposure of properties listed for sale.

The Canadian Real Estate Association (CREA) is one of Canada’s largest single-industry trade associations. CREA works on behalf of more than 125,000 REALTORS® who contribute to the economic and social well-being of communities across Canada. Together they advocate for property owners, buyers and sellers.

Further information can be found at http://crea.ca/statistics.

For more information, please contact:

Pierre Leduc, Media Relations

The Canadian Real Estate Association

Tel.: 613-237-7111 or 613-884-1460

E-mail: pleduc@crea.ca

No Comments